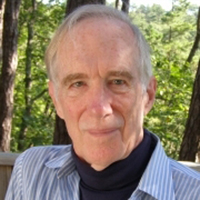

This annual lecture honors the life’s work of Robert J. Lampman, a professor of economics at UW–Madison for over 30 years and IRP’s founder and guiding spirit. The lecture features eminent poverty scholars discussing their research on the topics to which Lampman devoted his intellectual career: poverty, the distribution of income and wealth, and related public policy. The lecture is held on the UW-Madison campus and is open to the public. Videos and transcripts of past lectures, as well as the opportunity to donate to the Robert J. Lampman Memorial Fund are available on this website.

2026 Robert J. Lampman Memorial Lecture

TBA

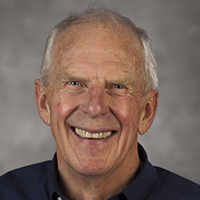

Katharine G. Abraham

Distinguished University Professor of Economics

University of Maryland

April 16, 2026

4:00–6:00 pm

Varsity Hall Ill (2nd Floor)

Union South

Robert J. Lampman Memorial Fund

A memorial has been established by the Lampman family with the help of the University of Wisconsin Foundation to support this lecture series. The lecture series, organized by IRP in cooperation with the UW–Madison Department of Economics, offers a special opportunity to maintain and nurture interest in poverty research among the academic community and members of the public. Contributions to the fund are welcome, to ensure continuation of the lectures. The Institute can accept donations through a secure online giving form provided by the UW Foundation. The form will be pre-filled with information necessary to direct your gift to the Robert J. Lampman Memorial Fund. For more information on how to contribute to IRP please see Make a Gift.